Georgia Car Sales Tax Rate Calculator

Used Car Tax Calculator Georgia. Instead the state enforces an auto.

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax.

Georgia car sales tax rate calculator. You can also enter additional fields such as the trade-in value of an existing car or the down payment if you are financing the car. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. 4 is the smallest possible tax rate 30323 Atlanta Georgia 6 775 8 are all the other possible sales tax rates of Atlanta area.

Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses. Take the price of a taxable product or service and multiply it by the sales tax rate. There is also a local tax of between 2 and 3.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Georgia local counties cities and special taxation districts. With sales tax though its almost never that easy.

This means that depending on your location within Georgia the total tax you pay can be significantly higher than the 4 state sales tax. FMV Trade-in x Rate TAVT liability. At a glance calculating sales tax seems simple.

If the sale included a trade-in the FMV is first reduced by that amount before multiplying by the applicable rate to determine the TAVT due. Furthermore economic nexus may be triggered. Depending on local municipalities the total tax rate can be as high as 9.

Georgia collects a 4 state sales tax rate on the purchase of all vehicles. States Georgias tax system ranks close to the middle of the pack for the burden its tax system places on taxpayers. Simply enter the loan amount term length and interest rate above and the Georgia car loan calculator with extra payments will calculate your monthly car loan payments.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. 087 average effective rate. However this retail sales tax does not apply to cars that are bought in Georgia.

The state has a retail sales tax of 4 however this does not apply to motor vehicles purchased in the state. For vehicles that are being rented or leased see see taxation of leases and rentals. 89 is the highest possible tax rate Atlanta Georgia The average combined rate of every zip code in Georgia is 7104.

89 is the highest possible tax rate 30301 Atlanta Georgia The average combined rate of every zip code in Atlanta Georgia is 7393. 4 is the smallest possible tax rate Austell Georgia 6 7 775 8 are all the other possible sales tax rates of Georgia cities. According to CarsDirect Georgia has a state general sales tax rate of 4.

This tax is based on the value of the vehicle. For more information about COVID-19 in Georgia please visit our resource page or call the Georgia COVID-19 hotline at 844-442-2681. Combined state and local sales taxes.

2790 cents per gallon of regular gasoline 3130 cents per gallon of diesel. Georgia has no sales tax on new used vehicles but it does have a Title Ad Valorem tax of 7. Our calculator has recently.

A major part of the final cost of a new vehicle purchase can be the taxes youll need to pay and the registrationtitling fees youll owe to your states Department of Motor Vehicles DMV Motor Vehicle Division MVD Motor Vehicle Administration MVA Department. In addition to taxes car purchases in Georgia may be subject to. 26 Zeilen Select View Sales Rates and Taxes then select city and add percentages for total sales.

For more information go to Georgias TAVT FAQS. The current TAVT rate is 7 of the fair market value of the vehicle in most Georgia counties. Calculating Georgia car tax isnt the most pleasant of tasks but knowing what youll pay before you purchase a car can take some of the shock away before you sign on the dotted line.

Generally the TAVT is calculated by multiplying the applicable rate times the Fair Market Value FMV as defined by law. This calculator can estimate the tax due when you buy a vehicle. Georgia has a 4 statewide sales tax rate but also has 312 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3526 on top of the state tax.

The real trick is figuring out what needs to be taxed and then calculating the correct tax rate which depending on how your business operates could mean learning the rules in any number of the more. Ad Valorem Title Tax TAVT People who purchase a new or used vehicle pay a one-time Ad Valorem Title Tax. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

After calculating sales tax depending on the new car sales tax rate you may find your total fess have increased significantly. View pg 1 of chart find total for location. This is a tax based on the value of the car not the sales price.

Annual Ad Valorem Tax Estimator Calculator Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Our car experts choose every product we feature. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their Georgia car tax.

The Georgia GA state sales tax rate is currently 4. Title Ad Valorem Tax TAVT became effective on March 1 2013. Georgia Car Loan Calculator.

Car Tax By State Usa Manual Car Sales Tax Calculator

General Tax Settings Adobe Commerce 2 4 User Guide

Georgia Used Car Sales Tax Fees

What S The Car Sales Tax In Each State Find The Best Car Price

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

![]()

Georgia New Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

California Used Car Sales Tax Fees 2020 Everquote

Tax Rates Gordon County Government

Sales Tax Software Tax Software Sales Tax Online Business

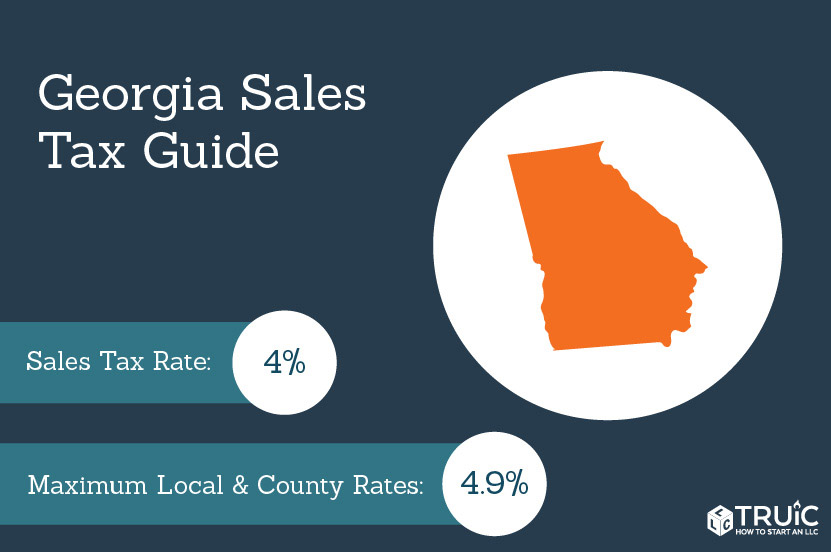

Georgia Sales Tax Small Business Guide Truic

Calculateme Com Calculate Just About Everything Area Of A Circle Calculator Butter Storage

States With Highest And Lowest Sales Tax Rates

Indiana State Sales Tax Overview Indiana State Sales Tax Tax Guide

Posting Komentar untuk "Georgia Car Sales Tax Rate Calculator"