Georgia Trade In Car Tax Credit

-- Starting July 1 new-car buyers can deduct the value of a trade-in from the value of the new vehicle when paying the 6 percent motor vehicle usage tax. Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly.

Selling Or Trading In Your Car To Carvana How It Works Carvana

Tax Credit Property List.

Georgia trade in car tax credit. In seven other states there is no credit or sales tax reduction when you. One little-noticed change affects trade-ins of vehicles uses for business. Georgia Tax Center Information Tax Credit Forms.

31 rader One major benefit to trading-in your used car is most States give you a tax credit when. Georgia Department of Revenue - Motor Vehicle Division Title Ad Valorem Tax TAVT Informational Bulletin Trade-In Value for Leased Vehicles Updated July 31 2014 The purpose of this bulletin is to clarify and explain the appropriate reduction for Trade-in Value under OCGA. The Tax Cuts and Jobs Act TCJA has resulted in many changes in the tax laws.

Providing resources tools and technical assistance to cities counties and local authorities to help strengthen communities. Lets go over the tax changes for business vehicle trade-ins. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the vehicle.

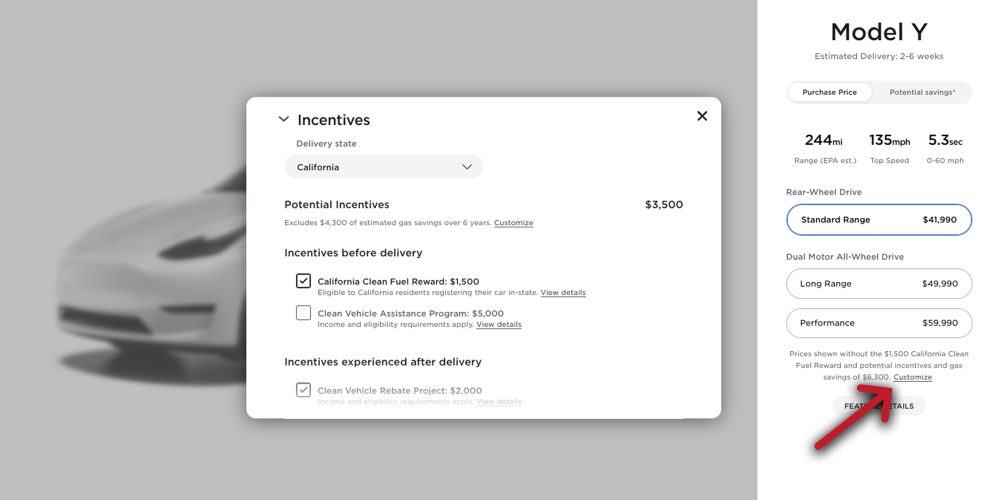

Statutorily Required Credit Report. FAQ for General Business Credits. 20 of the vehicle cost up to 5000 if you purchase or lease a zero emission vehicle ZEV.

The state of Georgia had an EV tax credit. In Georgia the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. To qualify your base port traffic amount must equal at least 10 TEU Twenty-Foot Equivalent units.

Income Tax Credit Policy Bulletins. How the tax credit works. Family transfer - Form MV-16 Affidavit to Certify Immediate Family Relationship required.

Registered motor vehicle dealer may deduct a trade-in allowance from the taxable sales price of a motor vehicle when in a single transaction tangible personal property not real property is traded as part of the motor vehicle sale. A Republican-backed bill introduced in Georgias House of Representatives would reinstate a 2500 state tax credit for the purchase or lease of new electric zero emission and plug-in hybrid. From October 2019 to March 2020 the credit drops to 1875.

For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. After that the credit phases out completely. Income Tax Credit Utilization Reports.

The state of Oregon has no sales tax so if you live in that state and buy a car the tax calculation is easy -- zero. Generally any motor vehicle purchased on or after March 1 2013 and titled in Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the birthday tax. If the bill is made law the tax credit would be 2500 for new electric vehicles plug-in hybrids and zero-emission vehicles.

If the sale is between individuals not registered with the Department the purchaser must in a single transaction trade an aircraft boat motor vehicle or mobile home for the motor vehicle. The previously used calculation method based on vehicle value either the value contained in the DOR assessment manual or the agreed upon value contained in the lease agreement whichever is higher or. Nissan is expected to be the third manufacturer to hit the limit but as of this writing its still 70000 sales away from this.

If you purchased or leased a vehicle on or before this date you can get a Georgia income tax credit of. Tax-deferred exchange of trade-in business car Until 2017 you could do a tax-deferred exchange of a. Income Tax Letter Rulings.

From April 2019 qualifying vehicles are only worth 3750 in tax credits. Qualified Education Expense Tax Credit. 48-5C-1 in the context of leased motor vehicles.

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. Community Economic Development. Effective January 1 2018 Georgia House Bill 340 requires that the Department of Revenue DOR provide two methods of calculating TAVT for new leased vehicles.

Get the estimated TAVT tax based on the value of the vehicle using. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of5 of the fair market value of the vehicle. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019.

Connecting communities to funding sources to help build capacity and encourage economic development while honoring the community. If your company increases imports or exports through a Georgia port by 10 and if you qualify for the Georgias Job Tax Credit or Investment Tax Credit youre also eligible for the Port Tax Credit Bonus. 10 of the vehicle cost up to 2500 if you purchase or lease a low emission vehicle LEV.

Trade In Car Or Sell It Privately The Math Might Surprise You

States That Allow Trade In Tax Credit

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

States That Allow Trade In Tax Credit

Virginia Sales Tax On Cars Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

How To Transfer A Car Title In Ga How To Replace A Car Title In Ga

Selling Or Trading In Your Car To Carvana How It Works Carvana

States That Allow Trade In Tax Credit

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax On Cars And Vehicles In Georgia

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Posting Komentar untuk "Georgia Trade In Car Tax Credit"